*Note: Content from other sources is written in normal, my original content is in italic

Today I will write about OYO: What it is, its business model, and my doubts on its future.

Oyo – What is it? (source: quartz)

Oyo Rooms is an Indian hotel chain. It is the world’s third-largest and fastest-growing hospitality chain of leased and franchised hotels, homes and living spaces. (Read more on Wikipedia)

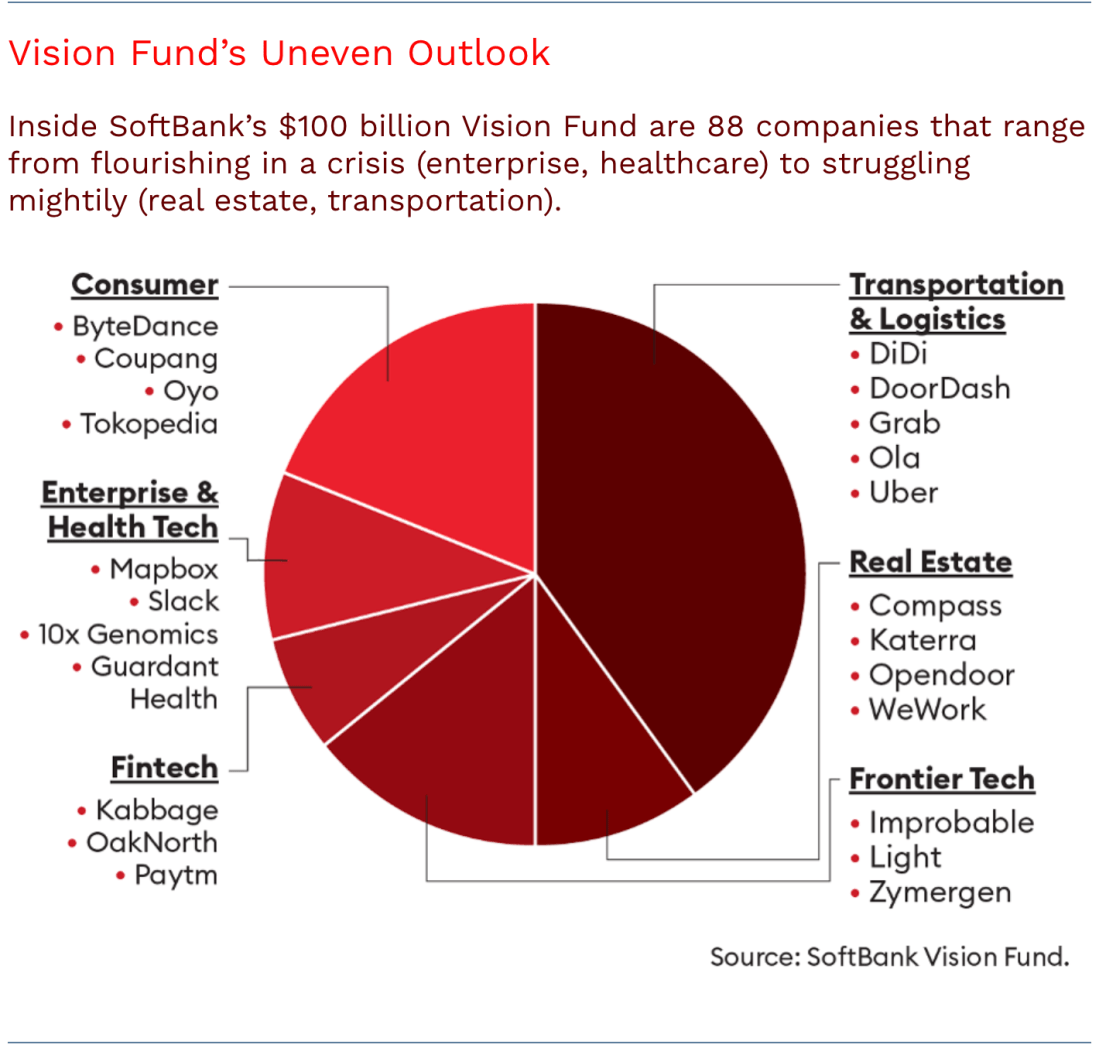

On Step 25, 2018 OYO Rooms had secured $1 billion in fresh funding. The capital infusion was led by existing investors SoftBank Vision Fund, Sequoia Capital, and Lightspeed Venture Partners. The funding makes OYO India’s latest unicorn, and the second-most valuable after One97 Communications.

Oyo Business model (source: bstrategyhub.com)

Oyo started as a hotel aggregator and used to lease some rooms and sell them under its brand name. However, it changed its business model from the aggregator to the franchise model. It involved partnering with hotels, asking them to operate as a franchise, and selling their rooms to customers at competitive prices.

Oyo does not own hotel properties that are listed on their website. Oyo renovates the hotels according to its checklist of standard services, and makes the hotel property a part of its “standardized budget hotel chain” with Oyo’s branding. Their focus is user experience (achieved by standardized services) rather than availability and price as other hotel chains.

Customer segments: focus on backpack and leisure travellers. Customers get access to Oyo via its website or mobile app.

Product portfolio: (1) Oyo Townhouse for millenials, (2) Oyo Flagship – premium, (3) Oyo B Direct serves business class, (4) Weddingz.in: wedding place lease, (5) Oyo Wizard: a subscription service,…

How does Oyo make money?

- Commissions: 22% of commissions every month from hotels owners

- Membership fees from Oyo Wizard, a subscription model where wizard members can get available exclusive discounts, offers, deals, and cash back advantages

- Advertising, sponsorship and partnership

- Consulting Services: business consulting and data analysis services for other hotel chains

Why I think Oyo’s future is gloomy

- The unclear value proposition

The core USP “budget with high-quality” is not sustainable. Both the aggregator and franchising model are hard to control when it expands to other market. Also, the exit barrier is low. It’s likely hotel owners or Oyo employees exit the company after a time, and work with other platforms with lower commission fee . Besides, it’s impossible if Oyo wants to be a digital/analytics company as their main assets/core advantages is a relationship network with hotel owners, not technology

- Market expansion is on the brink of collapse

Oyo easily succeeded in India, where most people are in the middle class, and technology/internet is on its growth peak. The story is different in other countries, where the internet competition is higher and people are less price-sensitive. Let’s take China for example. It’s reported that Meitu and Ctrip (the biggest OTAs in China) refused to work with Oyo as they offer the same type of services as the Indian company. Also, there were a large number of poor service reports in other markets (quartz).