It’s better to start with why you should learn case solving. From my experience, 3 reasons:

(1) Keep up with the business world, gain practical knowledge and skills through up-to-date cases. It’s extremely meaningful to me, as university classes are mostly theory-based with out-of-date case studies.

(2) Expand relationship network. Join case competitions, make new friends, and network with MNCs’ employees.

(3) Get future job opportunities. After joining business case competitions, you will have stories to tell in the job interview & you can get the position by employee reference after the case competitions.

And now, how to start?

(1) Read fundamental books. You can get the list from internet, but here is my recommendation: [Huy Luu] Case Books

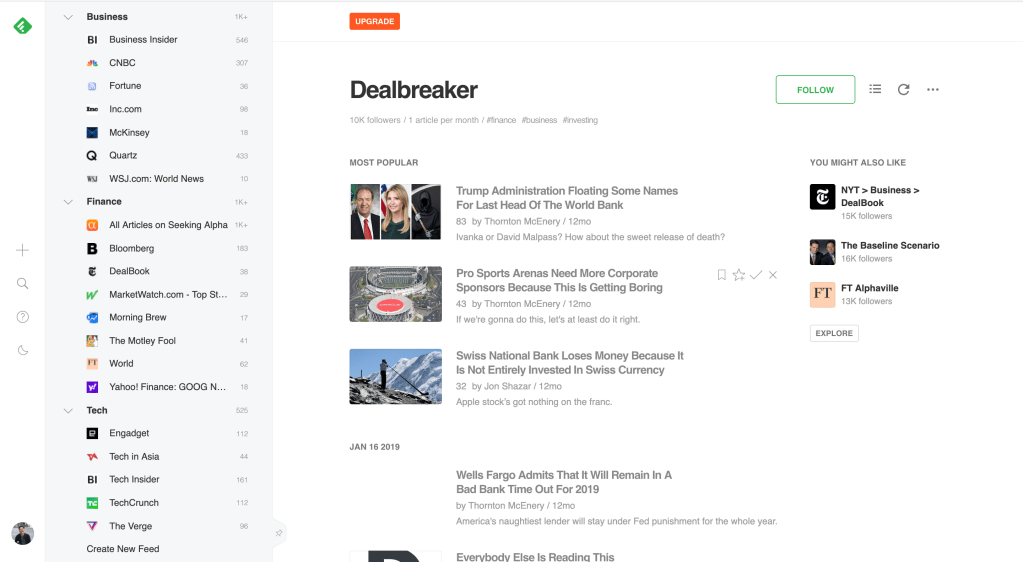

(2) Start the habit of reading news every day. Below are some of the sources that I am following now, I use Feedly.com, a website that allows you to include all the news sources in one place. My mentor Nam Le introduced this website to me. Besides, I subscribe to email newsletter from Finimize and PitchBook.

(3 – most important) Find a learning partner. He/she will be the one who reads & discusses books/news with you. Then maybe, set up a case team to join business case competitions/recruitment programs together.

After these steps, you can jump into some case competitions to apply what you have read, or just follow those habits to expand your knowledge